What is a Budget ? Components of Government Budget

What is a Budget ? Meaning and Concept

What is a Budget ? Meaning and Concept

Government has several policies to implement in the overall task of performing its functions to meet the objectives of social & economic growth. For implementing these policies, it has to spend huge amount of funds on defence, administration, and development, welfare projects & various other relief operations. It is therefore necessary to find out all possible sources of getting funds so that sufficient revenue can be generated to meet the mounting expenditure.

Image Credits © The Prime Minister's Office.

Planning process of assessing revenue & expenditure is termed as Budget.

The term budget is derived from the French word "Budgette" which means a "leather bag" or a "wallet". It is a statement of the financial plan of the government. It shows the income & expenditure of the government during a financial year, which runs generally from 1stApril to 31st March.

Budget is most important information document of the government. One part of the government's budget is similar to company's annual report. This part presents the overall picture of the financial performance of the government. The second part of the budget presents government's financial plans for the period upto its next budget.

So, every citizen of a nation from the common man to the politician is eager to know about the budget as they would like to get an idea of the :-

- Financial performance of the government over the past one year.

- To know about the financial programmes & policies of the government for the next one year.

- To know how their standard of living will be affected by the financial policies of the government in the next one year.

Definitions of Budget

Definitions of Budget

According to Tayler, "Budget is a financial plan of government for a definite period".

According to Rene Stourm, "A budget is a document containing a preliminary approved plan of public revenues and expenditure".

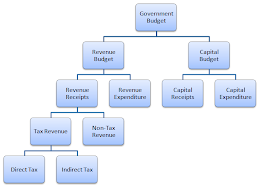

Components of Government Budget

Components of Government Budget

The main components or parts of government budget are explained below.

1. Revenue Budget

This financial statement includes the revenue receipts of the government i.e. revenue collected by way of taxes & other receipts. It also contains the items of expenditure met from such revenue.

(a) Revenue Receipts ↓

These are the incomes which are received by the government from all sources in its ordinary course of governance. These receipts do not create a liability or lead to a reduction in assets.

Revenue receipts are further classified as tax revenue and non-tax revenue.

i. Tax Revenue :-

Tax revenue consists of the income received from different taxes and other duties levied by the government. It is a major source of public revenue. Every citizen, by law is bound to pay them and non-payment is punishable.

Taxes are of two types, viz., Direct Taxes and Indirect Taxes.

Direct taxes are those taxes which have to be paid by the person on whom they are levied. Its burden can not be shifted to some one else. E.g. Income tax, property tax, corporation tax, estate duty, etc. are direct taxes. There is no direct benefit to the tax payer.

Indirect taxes are those taxes which are levied on commodities and services and affect the income of a person through their consumption expenditure. Here the burden can be shifted to some other person. E.g. Custom duties, sales tax, services tax, excise duties, etc. are indirect taxes.

ii. Non-Tax Revenue :-

Apart from taxes, governments also receive revenue from other non-tax sources.

The non-tax sources of public revenue are as follows :-

- Fees : The government provides variety of services for which fees have to be paid. E.g. fees paid for registration of property, births, deaths, etc.

- Fines and penalties : Fines and penalties are imposed by the government for not following (violating) the rules and regulations.

- Profits from public sector enterprises : Many enterprises are owned and managed by the government. The profits receives from them is an important source of non-tax revenue. For example in India, the Indian Railways, Oil and Natural Gas Commission, Air India, Indian Airlines, etc. are owned by the Government of India. The profit generated by them is a source of revenue to the government.

- Gifts and grants : Gifts and grants are received by the government when there are natural calamities like earthquake, floods, famines, etc. Citizens of the country, foreign governments and international organisations like the UNICEF, UNESCO, etc. donate during times of natural calamities.

- Special assessment duty : It is a type of levy imposed by the government on the people for getting some special benefit. For example, in a particular locality, if roads are improved, property prices will rise. The Property owners in that locality will benefit due to the appreciation in the value of property. Therefore the government imposes a levy on them which is known as special assessment duties.

iii. India's Revenue Receipts :-

The tax revenue provides major share of revenue receipts to the central government of India. In 2006-07 tax revenue (direct + indirect taxes) of central government was Rs. 3,27,205 crores while non-tax revenue was Rs. 76,260 crores.

(b) Revenue Expenditure ↓

i. What is Revenue Expenditure ?

Revenue expenditure is the expenditure incurred for the routine, usual and normal day to day running of government departments and provision of various services to citizens. It includes both development and non-development expenditure of the Central government. Usually expenditures that do not result in the creations of assets are considered revenue expenditure.

ii. Expenses included in Revenue Expenditure :-

In general revenue expenditure includes following :-

- Expenditure by the government on consumption of goods and services.

- Expenditure on agricultural and industrial development, scientific research, education, health and social services.

- Expenditure on defence and civil administration.

- Expenditure on exports and external affairs.

- Grants given to State governments even if some of them may be used for creation of assets.

- Payment of interest on loans taken in the previous year.

- Expenditure on subsidies.

iii. India's Defence Expenditure :-

In 2006-07, Defence expenditure of the central government of India was Rs. 51,542 crores.

2. Capital Budget

This part of the budget includes receipts & expenditure on capital account projected for the next financial year. Capital budget consists of capital receipts & Capital expenditure.

(a) Capital Receipts ↓

i. What are Capital Receipts ?

Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

ii. Items included in Capital Receipts :-

The main items of Capital receipts (income) are :-

- Loans raised by the government from the public through the sale of bonds and securities. They are called market loans.

- Borrowings by government from RBI and other financial institutions through the sale of Treasury bills.

- Loans and aids received from foreign countries and other international Organisations like International Monetary Fund (IMF), World Bank, etc.

- Receipts from small saving schemes like the National saving scheme, Provident fund, etc.

- Recoveries of loans granted to state and union territory governments and other parties.

(b) Capital Expenditure ↓

i. What is Capital Expenditure ? :-

Any projected expenditure which is incurred for creating asset with a long life is capital expenditure. Thus, expenditure on land, machines, equipment, irrigation projects, oil exploration and expenditure by way of investment in long term physical or financial assets are capital expenditure.

Conclusion On Budget

Conclusion On Budget

Thus, we see that the budget mirrors projected receipts and expenditures.

October 22, 2012 at 3:52 PM

Your essay is highly informative, Gaurav. I'm bookmarking it. It is interesting to share experiences from other countries. Thank you very much.

But I need a few clarifications:

1. Does your views here tally with any known public sector accounting standard? If yes, which one is it?

2. You gave the following as examples of revenue expenditure: "Expenditure on agricultural and industrial development, scientific research, education, health and social services.

Expenditure on defence and civil administration" Does it mean that all expenditures on, say, Defence, education, scientific research and health are revenue expenditure? How about acquisition of war ship, building of hospital, etc?

I will like to interact further with you on PFM matters if you do not mind. I will try to reach you via LinkedIn.

Regards.

Sylva Okolieaboh

GIFMIS PFM Team Leader

Office of the Accountant General of the Federation,

Abuja

Nigeria.