What is Priority Sector Lending ? Meaning Areas

Priority Sector Lending Meaning

Priority Sector Lending Meaning

Priority sector plays an important role in the economic development of the country. Therefore, the Central (Federal) Government of any country gives this sector priority (first preference) in obtaining loans from banks at a low rate of interest. This is known as a ‘Priority Sector Lending’.

Following important points cover the core meaning of priority sector lending:

- Priority sector lending scheme is a policy of providing a specified portion of bank lending to the important sectors of the economy.

- It includes agriculture, small-scale industries, cottage sector, tiny sector, export sector, and other small business (service) firms.

- The Reserve Bank of India (RBI) was first to initiate priority sector lending scheme in India.

- The main purpose of this scheme was to see that timely and sufficient credits (loans) are given (provided) to the priority sector.

- Previously, only public sector banks were asked to give loans to this sector. However, now even private and foreign banks have to give loans to this sector.

Areas Under Priority Sector

Areas Under Priority Sector

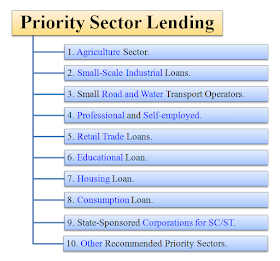

RBI has divided the priority sector into following ten areas or categories.

The main areas under priority sector lending scheme are as follows:

- Agriculture sector.

- Small-scale industrial loans.

- Small road and water transport operators.

- Professional and self-employed.

- Retail trade loan.

- Educational loan.

- Housing loan

- Consumption loan

- State-sponsored corporations for SC/ST.

- Other recommended priority sectors.

Now let's discuss individual areas under priority sector lending one by one.

1. Agriculture sector

In India, nearly one-third of its national income come from the agriculture sector. Its economic and social development directly depends on the expansion of the agriculture sector. Therefore, it is treated as primary priority sector lending in India.

Agricultural loans are given to the farmers on their need-based credit.

These loans are classified into following two categories:

- 1. Direct Agricultural Loans

Under this category, loans are directly given to the farmers in form of tractor loan, dairy loan, crop loan, etc. These loans are given either for a short-term period (which is not more than 12 months) or for a medium and long-term period (which is not more than 36 months).- Short-term loans are given to meet agricultural expenses and maintenance of assets such as a tractor, pumping machine, bore well, etc.

- Medium and long-term loans are given for agricultural activities like land reclamation, farm building, farm mechanization, and so on.

- 2. Indirect Agricultural Loans

Here, farmers are provided loans at concessional rates of interest. Indirect agricultural loans benefit the farmers in the long run. These loans are given for cattle feed, warehouse, seeds, pesticides, rural electrification, subscription of bonds issued by NABARD, boring equipments, etc.

2. Small-scale industrial loans

Loans given to small-scale and ancillary industries are treated as priority sector lending. These industrial units are those who do manufacturing, processing, and preservation of goods.

In case of these industries, investment made in fixed assets must not exceed the maximum limit notified by the Government of India. Such small-scale and ancillary industries create newer job opportunities in the market.

Small-scale and ancillary industries include tailoring, Xeroxing, typing centers, etc.

3. Small road and water transport operators

This category of borrowers includes owners of taxis, trucks, buses, auto-rickshaws, cars, bullock-carts, camel, etc. Under priority sector lending, small road and transport operators get loans based on the conditions mentioned in the notification issued by the Government of India.

The repayment period of loan is communicated to the borrower at the time of disbursement of loan.

Borrowing is done for the purchase of vehicles and their parts. Bank mainly provides loans for the following purposes:

- Purchase of vehicles.

- Purchase of spare parts.

- Carrying out major repairs.

- Working capital requirements.

4. Professional and self-employed

Under this category, bank provides loans to professionals like:

- Doctors,

- Chartered accountants,

- Architects,

- Engineers,

- Lawyers, etc.

Bank also provided loans to self-employed persons like:

- Freelance journalists,

- Owners of health care centers,

- Beauty parlors,

- Photographers,

- Fashion designers, and so on.

The borrowing limit will be an aggregate of fixed capital and working capital requirements of a professional and self-employed person.

Doctors and other self-employed professionals who start practicing in rural or semi-urban areas are also eligible to borrow loans.

5. Retail trade loan

Under priority sector lending, retail trader trading in fertilizers, mineral oil, fair price shops and consumers' co-operative stores get bank loans.

The loaned amount can be used to purchase fixed assets, tools and other equipments needed to carry on trading and its allied activities.

Image credits © Moon Rodriguez.

6. Educational loan

Education loan is given to those students who want to pursue higher education in India or abroad.

Generally, bank provides loans to students on the following conditions:

- The Government of India set limits on the amount of educational loan taken by students for pursuing studies in Indian and/or abroad.

- Students may undergo graduation, post graduation (masters) programs, professional programs and other job-oriented diplomas.

- Rate of interest on educational loan varies in accordance with the latest ‘Finance Bill’ issued by the Government of India.

7. Housing loan

Types of housing loan under priority sector lending are depicted below.

Under housing loan facilities, following types of loans are available for:

- Construction of a house.

- Repair (maintenance) and/or renewal of a house.

- Clearance of slums and rehabilitation of disaster-stricken masses to temporary refuge shelters.

8. Consumption loan

Banks provide the consumption loan to weaker sections of society that include small farmers, landless agricultural workers, rural artisans, barbers, washer men, carpenters, and so on who have no savings in their hands.

People of weaker sections need to borrow money for their immediate requirements like marriage, festivals, illnesses, etc.

Consumption loan is given for such non-productive purposes.

Here, loan limit is prescribed on each family.

9. State-sponsored corporations for SC/ST

Priority sector lending includes loans given to state-sponsored corporations for the promotion of scheduled castes (SC) and scheduled tribes (ST).

Banks are given freedom to decide the amount and also the terms and conditions for these loans.

10. Other recommended priority sectors

Some other recommended priority sectors are depicted below:

These are listed and briefly explained as follows:

- 1. Software Industry

Here, loans are given to a software industry up to a limit as per the notification issued by the government of India.Software professionals are given loans under the category of “Loans to professionals and self-employed”.

- 2. Venture Capital

If the venture capital project is registered with ‘SEBI’ (Securities and Exchange Board of India) then it will be included in the priority sector lending.It will get a loan under priority sector lending scheme.

November 16, 2014 at 6:54 AM

thanks to articles

from here i got all the information related to banks

which will play important roll to get selection

today i m very happy

thanks again