Benefits of Credit Rating to Investors and Company

Benefits of Credit Rating to Investors

Benefits of Credit Rating to Investors

The advantages, importance or benefits of credit rating to the investors are:-

Imgage Credits © Sameer Akrani.

- Helps in Investment Decision : Credit rating gives an idea to the investors about the credibility of the issuer company, and the risk factor attached to a particular instrument. So the investors can decide whether to invest in such companies or not. Higher the rating, the more will be the willingness to invest in these instruments and vise-versa.

- Benefits of Rating Reviews : The rating agency regularly reviews the rating given to a particular instrument. So, the present investors can decide whether to keep the instrument or to sell it. For e.g. if the instrument is downgraded, then the investor may decide to sell it and if the rating is maintained or upgraded, he may decide to keep the instrument until the next rating or maturity.

- Assurance of Safety : High credit rating gives assurance to the investors about the safety of the instrument and minimum risk of bankruptcy. The companies which get a high rating for their instruments, will try to maintain healthy financial discipline. This will protect them from bankruptcy. So the investors will be safe.

- Easy Understandability of Investment Proposal : The rating agencies gives rating symbols to the instrument, which can be easily understood by investors. This helps them to understand the investment proposal of an issuer company. For e.g. AAA (Triple A), given by CRISIL for debentures ensures highest safety, whereas debentures rated D are in default or expect to default on maturity.

- Choice of Instruments : Credit rating enables an investor to select a particular instrument from many alternatives available. This choice depends upon the safety or risk of the instrument.

- Saves Investor's Time and Effort : Credit ratings enable an investor to his save time and effort in analyzing the financial strength of an issuer company. This is because the investor can depend on the rating done by professional rating agency, in order to take an investment decision. He need not waste his time and effort to collect and analyse the financial information about the credit standing of the issuer company.

Benefits of Credit Rating to Company

Benefits of Credit Rating to Company

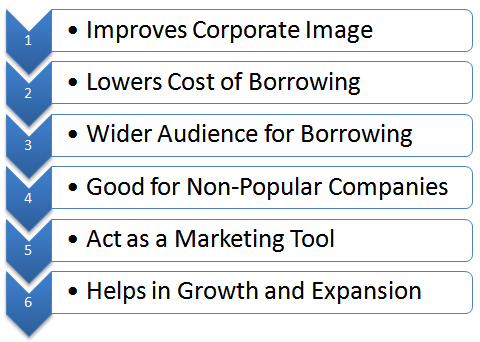

The merits, advantages, benefits of credit rating to the issuing company are:-

Imgage Credits © Sameer Akrani.

- Improves Corporate Image : Credit rating helps to improve the corporate image of a company. High credit rating creates confidence and trust in the minds of the investors about the company. Therefore, the company enjoys a good corporate image in the market.

- Lowers Cost of Borrowing : Companies that have high credit rating for their debt instruments will get funds at lower costs from the market. High rating will enable the company to offer low interest rates on fixed deposits, debentures and other debt securities. The investors will accept low interest rates because they prefer low risk instruments. A company with high rating for its instruments can reduce the cost of public issue to raise funds, because it need not spend heavily on advertising for attracting investors.

- Wider Audience for Borrowing : A company with high rating for its instruments can get a wider audience for borrowing. It can approach financial institutions, banks, investing companies. This is because the credit ratings are easily understood not only by the financial institutions and banks, but also by the general public.

- Good for Non-Popular Companies : Credit rating is beneficial to the non-popular companies, such as closely-held companies. If the credit rating is good, the public will invest in these companies, even if they do not know these companies.

- Act as a Marketing Tool : Credit rating not only helps to develop a good image of the company among the investors, but also among the customers, dealers, suppliers, etc. High credit rating can act as a marketing tool to develop confidence in the minds of customers, dealer, suppliers, etc.

- Helps in Growth and Expansion : Credit rating enables a company to grow and expand. This is because better credit rating will enable a company to get finance easily for growth and expansion.

-

Anonymous

said...

October 12, 2013 at 8:43 AMone more benefit that can be added to the above article is, Credit rating provides information to the company (borrowing entity) about its financial standing as per credit assessment by Rating agencies. Hence, companies get a chance to set their house in order.

-

Harsh Bohra

said...

March 28, 2015 at 9:13 AMBenefits of Credit Rating:

A. To Investors:

a. Get superior information at low costs.

b. Investors can calculate risks in their investment decisions.

c. Encourages individuals to invest his savings and earn higher returns on his savings.

B. To Corporate/Companies/Borrowers:

a. Good Credit Rating Companies can enter capital market efficiently

b. Used as marketing tool

c. Facilitates foreign collaborations

d. Encourages discipline amongst corporate borrowers

e. High credit rating attracts investors

f. High credit rating minimizes/reduces costs to issue

g. Goodwill/Reputation increases with high credit scores

C. To Government:

a. Good rating motivates public to invest their savings

b. It guides in the formulation of public policies by the government.